Otto Money, an AI-powered wealth guidance platform, has raised $1.3 million in a pre-seed funding round led by Pravega Ventures.

The round also saw participation from a group of prominent angel investors, including Rishi Kohli (CIO at Jio BlackRock AMC), Amit Gupta (Founder of InMobi and Yulu), Amit Agarwal (Founder of NoBroker, and Mohit Aron (Founder of Nutanix and Cohesity), along with several existing investors.

The fresh funds raised will be used to strengthen its AI models, enhance personalization, and expand its goal-based guidance capabilities over the next 12 to 18 months.

The company will also focus on go-to-market initiatives in Tier 1 cities, including partnerships and brand-building efforts designed to establish long-term trust. A significant portion of the funding will go toward hiring across engineering, data science, and product.

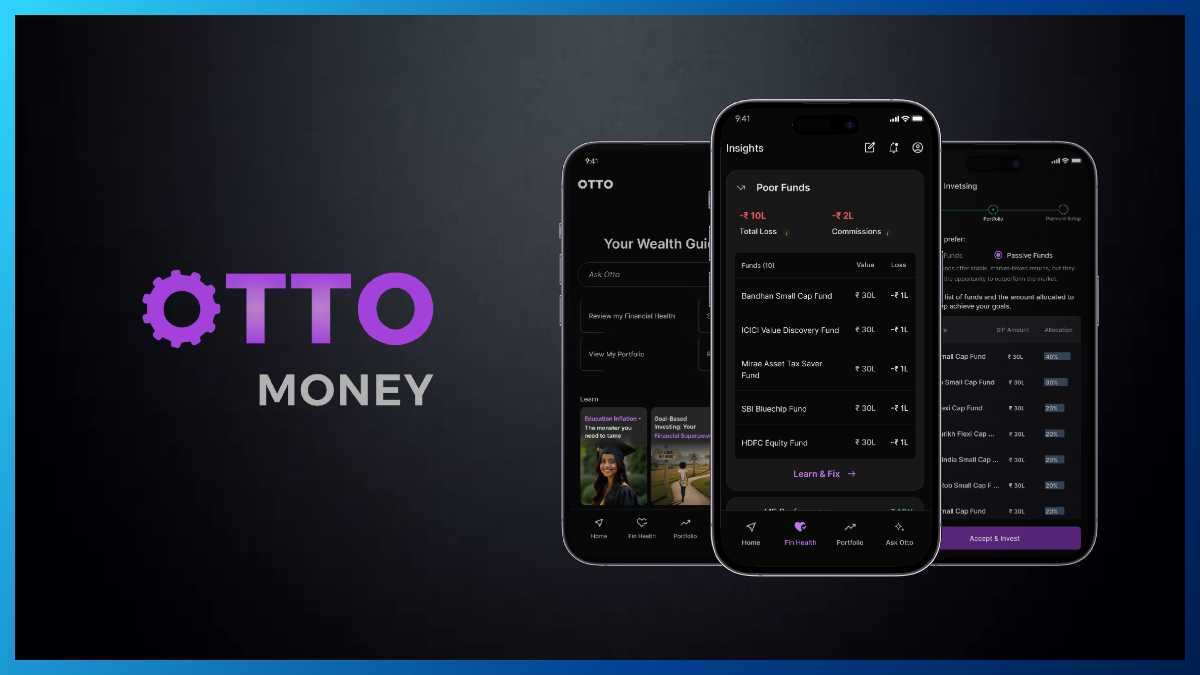

Founded in 2025 by Apurv Gupta and Ankur Lahoti, Otto Money is an AI-powered wealth guidance platform that provides AI-driven, unbiased, multi-asset, and goal-based wealth management guidance for retail investors.

Otto Money differentiates itself by using institution-grade investment models and AI to deliver holistic, multi-asset guidance that explains trade-offs, highlights risks, and aligns decisions with long-term financial aspirations without pushing specific products.

Otto Money operates at the intersection of fintech, wealth management, and artificial intelligence, serving digitally savvy Indian investors.

Otto Money tackles issues like information asymmetry, conflicted advice, poor multi-asset view, and decision fatigue during market swings. As an AI decision layer, the platform helps investors shift from reactive to disciplined, goal-focused wealth building.

Otto Money is currently in early market deployment and is seeing active engagement from digitally native investors. Over two to three years, it aims to enhance AI guidance, broaden investment scenario coverage, and expand in major Indian metros. It plans strategic partnerships within the financial ecosystem and builds a transparent, compliant platform supporting investors through various life stages and market cycles, focusing on long-term trust.

Apurv Gupta, Co-founder of Otto Money, said, “Indian investors today have access to more financial products than ever before, but clarity hasn’t scaled at the same pace. Otto Money is built to address that gap, using AI to help investors understand their choices, manage risk consciously, and stay aligned with long-term goals rather than short-term noise.”

Rohit Jain, Partner at Pravega Ventures, said, “At Pravega, we back founders who pair deep technical depth with absolute clarity of problem. Apurv and Ankur embody that engineering DNA in the way Otto is built. We didn’t just invest in another fintech app, but in a proprietary intelligence layer. While most of the industry is still pushing products, Otto is using AI to give Indian investors something much rarer with an institutional-grade clarity. This isn’t just about better advice but about reshaping the relationship between people and their money.”